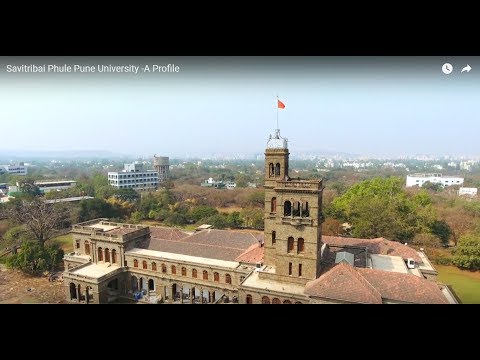

SPPU Diploma Taxation Law: Fees 2025, Course Duration, Dates, Eligibility

Pune, MaharashtraState UniversityEstd 1949

Course Finder

Compare

Claim this college

Course Description

Diploma in Taxation is a Diploma level Income Tax Commerce course. Taxation is a process of imposing a financial charge or another levy upon a taxpayer (an individual or legal entity) by a state or the functional equivalent of a state such that failure to pay is punishable by law.

Diploma in Taxation Course Suitability

- The course is suitable for those who are willing to go for teaching fields at higher degree level i.e. college and university level both in private and government institutions.

- They should have the ability to thinking, a creative and innovative mind, good communication skills, up to date with awareness, abundant knowledge about the taxation sector and the market.

- Candidates must have the ability to work as part of a team as it is necessary for course and job. Applicants should have strong problem-solving skills, proficiency with the Microsoft Office software suite and excellent Excel spreadsheet skills.

- A strong sense of work ethics and a desire are also essentials for it.

Course Highlights

Details

| Full Form | Diploma in Taxation Law |

| Duration | 1 Year |

| Eligibility | Graduation |

| Admission Mode | Online/offline |

| Employment Areas |

|

| Job Types |

|

Eligibility Criteria

Aspirants seeking admission to 1 year Full-time Diploma Program should have Bachelor’s degree in relevant stream from recognized College/University.

Admission Guidelines

How is Diploma in Taxation Course Beneficial?

- They can go for higher degree program in respective subjects such as Graduation and Masters Degree and then for research work.

- They have also options in the income tax department as a consultant or an income tax advisor, a person who helps you in filing your income tax returns every year.

- Students also can go for the business tax field as a consultant gives advice to business houses regarding the various business tax issues that are plaguing them.

- The course also gives knowledge regarding the tax system in India for students’ understanding

Course Details

Diploma in Taxation Syllabus

| Sr. No. | Subjects of Study |

|---|---|

| 1 | Definition Agriculture Income –Previous Year – Assess – Assessment year – Person – principal officer – Resident Ordinary resident – Non-resident – Deemed Income – Income exempt from Tax |

| 2 | Computation of Income from Salary |

| 3 | Computation of Income from House Property |

| 4 | Computation of Income from Business or Profession |

| 5 | Computation of Income from Capital gains and Income from other sources. |

| 6 | Deduction from gross total Income |

| 7 | Assessment of Individuals |

| 8 | Assessment of Partnership Companies |

| 9 | Assessment of Joint Stock Companies |

| 10 | Procedure for assessment – Filing of returns – Collection and recovery – Refund of Tax – Deduction of tax at source – Advance payment of Tax – Tax Credit Certificate |

| 11 | Introduction of Central Sales Tax Law – Important Definitions – CST ACT 1956 – concepts of Sale and Inter-State sales |

| 12 | Sale to Government – sale to Registered Dealer – exempted transactions |

| 13 | Liability to central sales Tax – Quantum of sales Tax – Procedure and forms under the CST Act |

| 14 | Restriction and conditions regarding tax on sale or purchase of declared goods within miscellaneous provisions. |

| 15 | Company in liquidation – Liability of directors in case of liquidation – CST appellate Authority – appeals, settlement of Disputes, Procedure, powers. |

| 16 | Value Added Tax (VAT):Introduction – Evolution of VAT in India – Meaning – Objectives – Features of VAT Laws –TNVAT Act,2006 – Definitions – Input tax credit system – Levy of taxes on sales – right to use any goods – Trans of goods involved in works contracts – refund of tax on sales returns – Deduction of tax at source in works contract exemption from tax. |

| 17 | Assessment in various cases – Liability of tax of persons – firms – Hindu Undivided family – private company – Appointment and powers of authorities Recovery Act – Appeals and revisions. |

| 18 | Introduction to service Tax Law – meaning, Definition and Concepts. |

| 19 | Liability of service Tax – payments and recovery of service Tax – Registration, requirement & procedure – Records and returns – Assessments, Revision and appeal – offences and penalties. |

| 20 | Summary provisions for various Taxable services – Advance ruling in service tax – service Tax Audit – service tax credit |

Show More

Important Updates

Course Finder

Search from 20K+ Courses and 35+ Streams

Clear

![Savitribai Phule Pune University - [SPPU]](https://image-static.collegedunia.com/public/college_data/images/logos/1483942831uop_logo.jpg?h=71.7&w=71.7&mode=stretch)

![Institute of Bioinformatics and Biotechnology - [IBB]](https://image-static.collegedunia.com/public/college_data/images/logos/1429507807jp.jpg?h=72&w=72&mode=stretch)

![Department of Management Science, Savitribai Phule Pune University - [PUMBA]](https://image-static.collegedunia.com/public/college_data/images/logos/14498279931444025326PUMBA.jpg?h=72&w=72&mode=stretch)

![Interdisciplinary School of Scientific Computing - [ISSC]](https://image-static.collegedunia.com/public/college_data/images/logos/1486384154logo..jpg?h=72&w=72&mode=stretch)

![Mumbai University - [MU]](https://image-static.collegedunia.com/public/college_data/images/logos/1481518208mu_logo.png?h=72&w=72&mode=stretch)

![Pondicherry University - [PU]](https://image-static.collegedunia.com/public/college_data/images/logos/1503565250logonew1.png?h=72&w=72&mode=stretch)

![Delhi University - [DU]](https://image-static.collegedunia.com/public/college_data/images/logos/1491817267UniversityofDelhi.png?h=72&w=72&mode=stretch)

Comments